CGTMSE Scheme for MSMEs

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) is a scheme launched by the Government of India to provide credit guarantee support to micro and small enterprises (MSEs). The scheme was launched in August 2000 and is operated by the Small Industries Development Bank of India (SIDBI) and the Ministry of Micro, Small and Medium Enterprises (MSME).

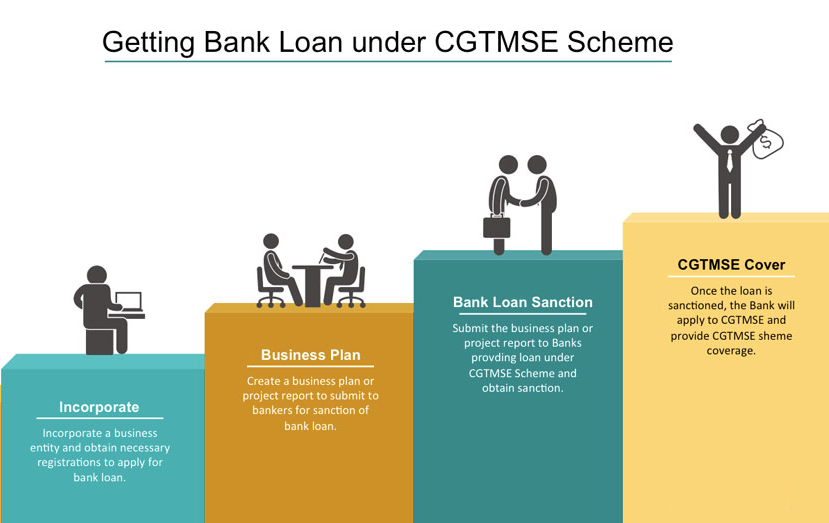

Under the CGTMSE scheme, MSEs can avail collateral-free loans up to Rs. 2 crores from banks and financial institutions without having to provide any collateral or third-party guarantee. The scheme provides a credit guarantee cover of up to 75% of the loan amount in case of default by the borrower.

Why choose CGTMSE Loans ?

My Mudra is a digital lending platform that provides small business loans, including loans guaranteed by the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). CGTMSE is a government initiative aimed at providing collateral-free credit to small businesses, including micro and small enterprises (MSEs).

If you are an MSE looking for funding and do not have collateral to offer, a CGTMSE loan may be a good option for you.

The loan is guaranteed by CGTMSE, which means that even if you default on the loan, the bank or financial institution that lent you the money will be reimbursed by CGTMSE up to a certain percentage of the loan amount.